Is Probability Analysis Causing Your Retirement Income Plan to Fail?

When planning your retirement, one of the most important questions—if not the most important—is How much can I withdraw from my portfolio? One of the biggest factors in determining that amount is market volatility. Probability Analysis—often called Monte Carlo Analysis—is often used to identify and manage the impacts of market volatility. But is probability analysis causing you to CHOOSE failure in your retirement income plan?

What is Probability Analysis?

First, let’s talk about what probability analysis is and what it does. Probability analysis is a method used to estimate the potential range of investment returns during retirement and the likelihood of achieving a target retirement income. For example, the software will take your portfolio structure and run hundreds, thousands, or even tens of thousands of hypothetical outcomes for your portfolio based on historical performance of the appropriate asset classes. The results would say something like “Your portfolio has a 90% chance to generate an income of $40,000 per year adjusted for inflation over your assumed life expectancy.”

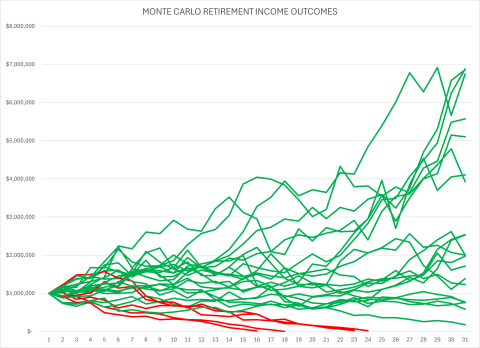

If you get to see a graphical output of probably analysis, there will be many lines representing some or all of the scenarios created (see a sample below). The ones that result in success may be green and those that fail may be red. In our example above, 90% of the lines would be green (better performance) and 10% would be red indicating a 10% portfolio failure rate.

The Limitations of Probability Analysis

So what’s the problem? The color of the lines only indicates the outcome concerning one goal—avoiding running out of money. With this strategy, income is based on the worst-case scenarios. The strategy is "Spend less in case something bad happens." (Why do so many advisors try to manage risk by telling you to spend less when the goal should be to spend more?)

The failure with probability analysis comes at the other end of the spectrum where you leave too much to heirs. Leave too much? When given the choice, most retirees would prioritize spending most of their assets on their own retirement lifestyle over leaving too many assets to heirs.

Balancing Retirement Lifestyle and Legacy

Let’s reframe the probability analysis results. How would you react to the following description?

Congratulations on accumulating over $1 million for retirement. Your diligence in saving has paid off. In order to have a 90% chance of not running out of money by age 90, we’ll start your retirement income at $40,000 and increase it each year to account for inflation. And there’s a 50% chance you will leave your children $2 million and, if things go well, maybe $5 million or more.

Your first reaction might be “Wait a minute! I thought that money was for me! I wasn’t planning on giving my kids that much.” You wouldn’t be alone. That’s one of the problems with using only probability analysis to manage volatility and determine your retirement income. It only addresses not running out of money in the portfolio. You may end up sacrificing the robustness of your retirement lifestyle in the process.

A Well-Rounded Retirement Strategy

So what’s the answer? Remember that probability analysis bases your retirement income on the worst-case scenarios. If we can improve the worst-case scenarios, we may be able to raise retirement income without increasing the risk. Probably analysis can be a valuable tool but can have issues if used as the only tool to manage risk.

There are other investment strategies that can greatly minimize market risk.

- FIXED PRODUCTS - There are financial accounts where your money can grow without market risk.

- INSURANCE PRODUCTS - Utilize insurance products with guarantees that transfer risk to someone else.

- CASH FLOW FEATURES - Utilize strategies that rely on cash flow-generating features such as dividends, interest and capital gains that can minimize the impacts of the change in value of your assets. The value of the assets is no longer the price. If you aren’t selling shares, is it important what their price is?

Adding some of these options to your retirement income plan can improve the worst-case outcomes and increase your retirement income. A retirement income plan that evaluates all the tools to build a well-rounded strategy to manage risk can generate more sustainable income versus using one tool alone.

Conclusion

Probability Analysis can be a valuable tool but can cause some unintended consequences when used alone to determine retirement income from an investment portfolio. A comprehensive retirement plan should balance multiple goals and incorporate various risk management tools to optimize retirement income and lifestyle.

If your goal is to pass the most money to your heirs even if that means sacrificing your retirement lifestyle and happiness, then maybe using only probability analysis to calculate your retirement income is right for you. For most people it’s not.

If you’d like to see how much you can increase your retirement income or have any questions about alternative strategies, give us a call at 512-538-6271 or CLICK HERE to schedule time to talk.